Gold ETFs: A Modern Approach to Gold Investment.

Gold ETFs are an innovative investment vehicle that offers exposure to the yellow metal without the need to hold physical gold. They have gained immense popularity due to their flexibility, ease of trading, and cost-effectiveness.

The presence of gold adds an additional layer of diversification within an investment portfolio, thereby reducing the overall risk of the portfolio.In an era of ever-shifting global financial landscapes, investors are increasingly searching for refuge from market turbulence and economic ambiguity. This quest for stability has revitalised interest in a traditional asset: gold. Historically, gold has been a sought-after sanctuary during economic upheaval, and its appeal is growing. While owning physical gold has been the traditional means of hedging against uncertainty, Gold Exchange-Traded Funds (ETFs) are emerging as a more practical, accessible, and flexible approach for investors to protect their wealth

The Allure of Gold in Uncertain Times

Gold has held a special place in the world of finance for centuries. Its intrinsic value as a tangible asset provides protection against various forms of market instability. During turbulent periods, gold's price tends to rise, making it an invaluable instrument for wealth preservation. Gold has a low correlation with other assets, particularly equities, making it an ideal choice to balance a portfolio in times of stock market volatility.

- Liquidity and Accessibility: Gold ETFs are traded on stock exchanges, making them highly liquid. Investors can buy and sell units of ETF just like stocks, offering easy access to the gold market.

- Transparency: One of the key advantages of gold ETFs is their pricing transparency. Investors can easily monitor the price of gold and consequently the performance of gold holdings.

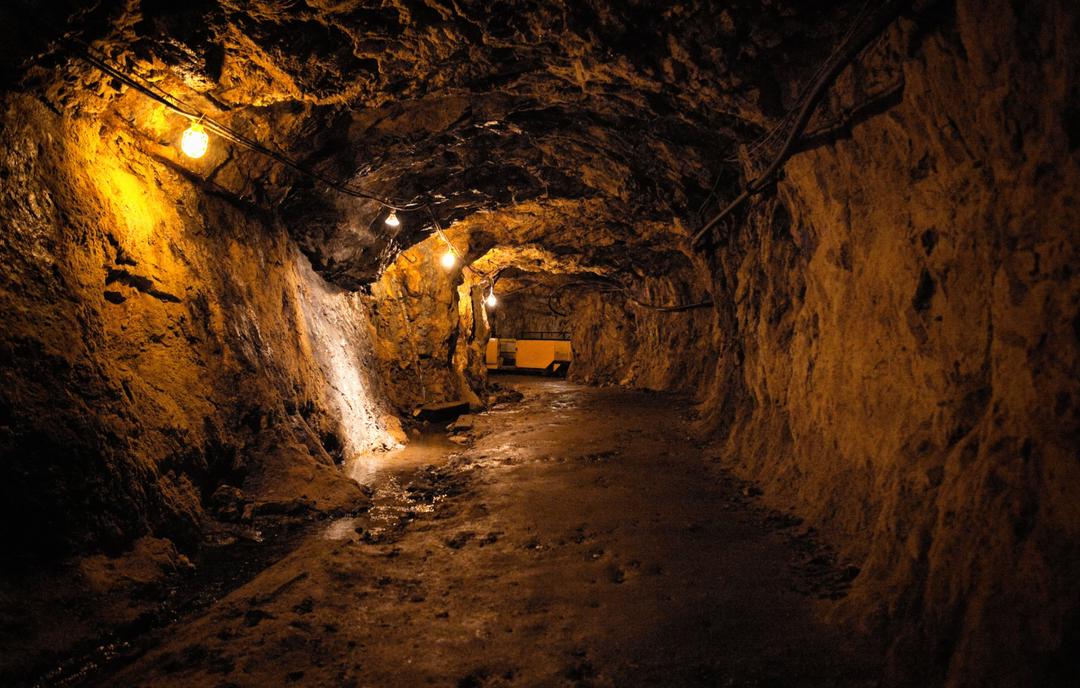

- No Storage Hassles: Owning physical gold comes with storage and security concerns. Gold ETFs eliminate these worries as investors do not need to store the metal physically. Instead, units of gold ETF are held in a demat account, eliminating the fear of theft.

- Affordability: One unit of ICICI Prudential Gold ETF costs approximately Rs. 54. Given the lower cost of acquisition, gold becomes accessible to a broader range of investors, even those with a limited budget.